Dentist

Implant Market Continues to Thrive

Kim Molinaro

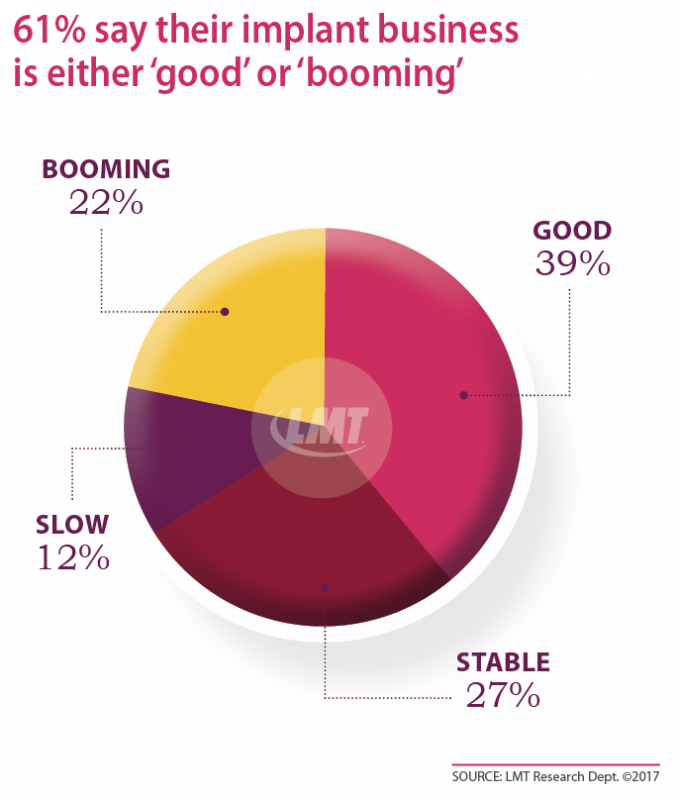

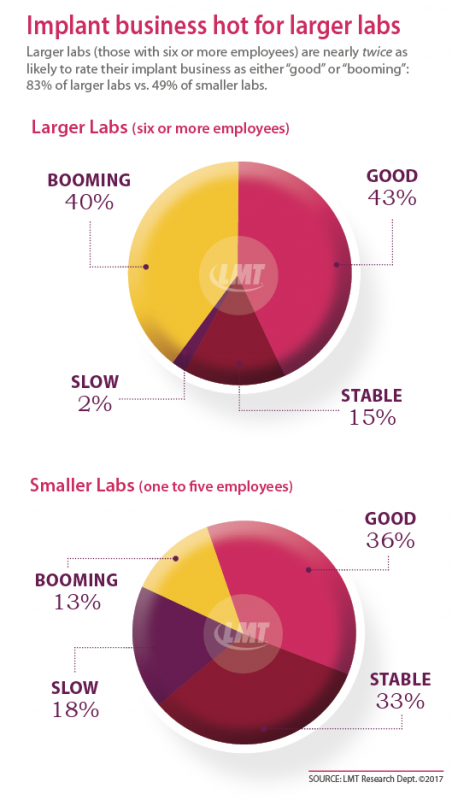

The implant market has been strong for the past decade—and shows no signs of slowing down. In fact, 86% of respondents to LMT’s 2017 Implant Survey* say their implant business has improved in the past three years, and 61% rate the state of their current implant business as either “good” or “booming.”

“Implants have become more and more vital to our bottom line,” says Jim Thacker, Vice President, Utah Valley Dental Lab, CDL, Provo, UT. “While profits on C&B have been squeezed, implants have remained a constant and increasing source of business.”

In addition, 59% say the profitability of their implant services has increased since 2014. This boost stems from reduced outsourcing fees by handling scanning and design in house, more competitive milling service fees, adding chairside implant services and focusing on cases with higher profit margins.

“We’ve started offering full-arch implant cases and the profit margin there is substantial,” says Jim Pierce, Co-Owner of BioAesthetics Dental Studio, a five-person operation in Grand Junction, CO. “We’re now receiving a large number of these cases and that alone has increased our bottom line. Although we had to spend a lot of time and money up front for training, it’s a long-term investment that’s paying off.”

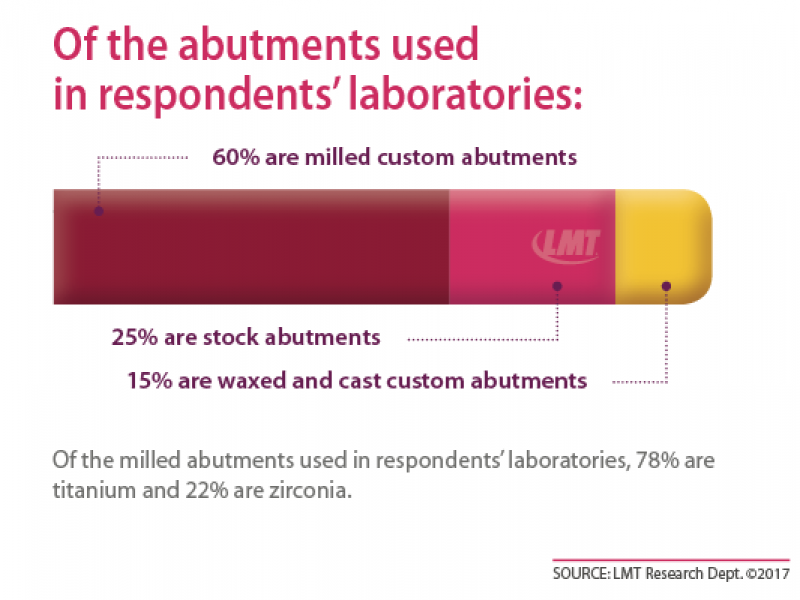

Digital advances have transformed this specialty over the last several years and respondents continue to tout custom-milled abutments and bars for their time and labor savings, quality of fit and higher success rates; advances in treatment planning like cone beam and CT scans; the use of intraoral scan bodies; and online services that allow labs that are outsourcing to view restorations prior to milling.

Screw-retained implant restorations are growing in popularity and respondents praise the key advances in this area. For instance, Ti-based abutments offer ease, predictability and efficiency, while angulated screw-channels (ASC) are also having a positive impact. “The ASC has significantly raised the ability to do screw-retained restorations that were not previously possible,” says Pierce.

Gary Schwandt, Owner, S & G Designs, Irvine, CA, agrees, saying this option creates a more esthetic result. “The angled implants make the result look more natural—as if the restoration is growing out of the tissue.”

Market Challenges

Despite the optimism and growth in the implant market, it’s not without its challenges. The biggest problem laboratories face, by far, is poor implant placement. “The implant market is growing great, but too many doctors are placing implants without a clue about how to restore them properly,” says a respondent from Colorado.

And while respondents overwhelmingly agree that presurgically planning implant cases gets everyone on the same page and results in increased predictability, better implant placement and higher success rates, many of them are still struggling to get clients on board. “Too many cases are engineered backwards. Getting some of our clients to consult with us before the implants are placed is an issue and the treatment plan then becomes a wild guess,” says the owner of a small lab in Ohio.

Another challenge: price-conscious dentists seeking cheaper, off-brand implant alternatives. As one respondent puts it, “It’s tough to compete using original manufacturer components when there are so many clones; manufacturers and labs are milling their own non-original parts at bottom-of-the-barrel prices.”

Looking to the future, the final piece of the puzzle for the market to reach its full potential is reducing the cost for the patient. “Implantology is becoming a standard treatment option and will be in every office one day. Patients are increasingly keen on seeking the implant option for missing teeth and will go elsewhere if their dentist doesn’t offer it,” says Jeff Hayes, CDT, Co-Owner of Genesis Dental Concepts in Sacramento, CA. “Once dental insurers grant mainstream status to this treatment, it will explode.”

Market Facts:

- 86% of survey participants say their implant business has improved in the last three years; 9% say it hasn’t changed and just 5% report a decline in business.

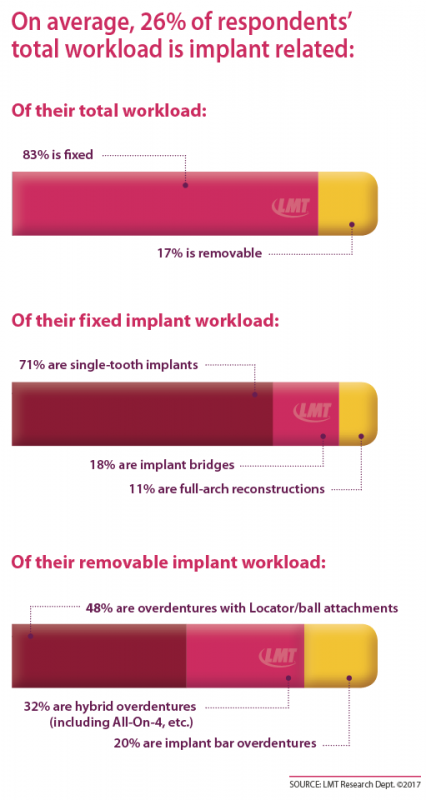

- On average, 65% of respondents’ dentist-clients are sending implant work and 26% of respondents’ total caseloads are implant related.

- 78% of respondents offer custom-milled abutments. Larger labs (those with six or more employees) produce an average of 62 abutments a month and smaller labs fabricate an average of 11 per month.

- 41% of respondents offer milled bars. Larger labs mill an average of five bars a month and smaller labs produce an average of two per month.

*This esurvey is based on 374 laboratory owners/managers: 64% are C&B, 28% are full service and 8% are removable. In terms of size, 75% operate one- to five-person labs, 17% are from six- to 20-person labs and 8% are from labs with more than 20 employees.